For many years Iran has been actively involved in Bitcoin mining, utilising its abundant and subsidised electricity, which includes power generated from nuclear energy. The country's involvement in Bitcoin mining has been significant, with estimates suggesting that Iran once held a 4.5% share of the global Bitcoin mining hash rate, although this has since decreased to about 3.1%.

The Iranian government officially recognized crypto mining as an industry in 2019 and introduced a licensing regime for miners, offering cheap electricity to attract investment.

The recent U.S. airstrikes on Iranian nuclear facilities, including the Fordo, Natanz, and Isfahan sites, have had an impact on Bitcoin mining operations in the country.

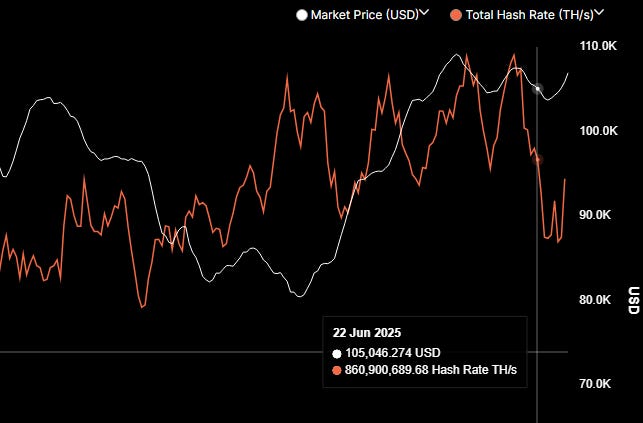

These strikes potentially disrupted power infrastructure close to major mining facilities, leading to power outages and forcing miners offline. The DRAMATIC drop in Bitcoin's global hash-rate following the airstrikes suggests that Iranian miners, who rely on subsidized electricity from fossil fuels and nuclear power, were halted by the disruptions.

Given the scale of Bitcoin mining in Iran and the country's use of nuclear energy for power, it is likely that some Bitcoin mining operations were powered by nuclear energy from the sites that were recently bombed.

Scale of IRGC involvement

Estimates suggest that well over half of all mining hardware in Iran is operated by state-related entities. According to investigative reporting, roughly 180,000 crypto mining devices were in use in Iran as of 2023, of which about 100,000 belong to the state or firms affiliated with the state (e.g. the IRGC). In other words, the IRGC and its partners control a majority share of Iran’s crypto mining capacity under the cover of a “legitimate” industry. These actors prioritize mining – and the hard currency it yields – over the needs of the public.

Notably, even as the energy crisis worsened, IRGC-affiliated media have sought to deflect blame by highlighting IRGC “crackdowns” on unauthorized miners – a public relations move given that the IRGC itself is not tasked with power enforcement, and its own mines are a core part of the problem.

The energy footprint of Iran’s crypto mining operations – particularly those tied to the state – is enormous. Precise figures are hard to pin down due to the secretive nature of many facilities, but both official and independent assessments agree that miners have become a significant drain on Iran’s power supply:

The disruption caused by the airstrikes supports the conclusion that Iran was mining Bitcoin using nuclear energy, as the attacks on these facilities directly impacted the country's mining capabilities and the shutting down of those facilities will cause loss of energy for civilian activities.

Refs:

US Attack on Iran Crashes Bitcoin Mining Hashrate: Fact Check

Bitcoin Hash Rate Falls After U.S. Strikes In Iran

Bitcoin Mining in Iran, IRGC Operations and the Power Grid Crisis - NCRI

—0—

If you appreciate my research but cannot commit to a paid subscription you could buy me a coffee at: https://www.buymeacoffee.com/FrancesLeader

Please note that all my work is entirely free to read and will never be hidden behind a paywall. My lovely paying subscribers contribute knowing this to be true and I would like to take this opportunity to thank them very much for their ongoing support.

The important thing is sharing this educational information on social media, especially on X and Facebook and Discord where I am permanently excluded because my work continues to upset the totalitarians.

United States (US)

The U.S. government remains the largest Bitcoin holder, with approximately 198,012 BTC (~$18.3 billion as of April 2025). However, this marks a slight decrease from July 2024, as the government liquidated portions of its holdings. A significant development was President Donald Trump’s executive order in March 2025 to create a “Digital Fort Knox”—a strategic cryptocurrency reserve consolidating Bitcoin from asset forfeitures.

China

Despite its ban on crypto trading and mining, China remains the second-largest governmental Bitcoin holder, now at 194,000 BTC (~$17.6 billion). Most of these assets originate from the 2019 PlusToken Ponzi scheme. While China has not liquidated these holdings, the government remains tight-lipped on future plans.

United Kingdom (UK)

The UK holds 61,000 BTC (~$5.6 billion), all acquired through crime-related seizures. The government has yet to decide whether to sell these holdings or use them for public finance needs, as suggested in recent policy discussions.

https://www.coingecko.com/research/publications/government-bitcoin-holdings

Useful additional information: https://cryptopolaris.substack.com/p/10-reasons-why-bitcoin-headed-to